How to trade on 22 October 2020 the Expiry day special?

- Ashish Singh ( Research Analyst)

- Oct 22, 2020

- 3 min read

Lets talk about 21st or last trading day market movement . Market open with gap up and went up by 60 points. But corrected 243 point from day high which clearly indicates fear among traders on higher levels whenever it try to reach up fear factor play big role and dragging the market. Hoever today nifty mange to close in green at 11775.

One thing is noticeable that nifty is trading within 500 points range in couple of weeks it made to cross 12000 twice abut did not sustain above 12000 and went down to below 11750. So now it is very necessary to see where it is going to headed.

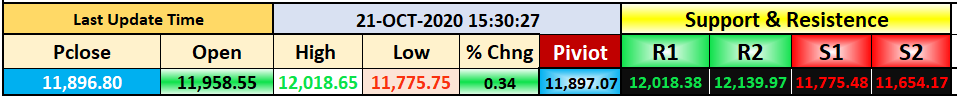

Broader level if you will look into the above table nearest resistance for nifty is placed at 12018 and support at 11775. Either nifty should cross 12018 or breach 11775 level down side.

If nifty manage to cross 12018 and at least sustain around half an hour to one hour we may see nifty touching 12200 soon within one or two session. But if nifty breach 11775 then it may go around 11200 or even below.

Now lets talk about Option chain data analysis:

ATM is 11950,

Call Side Data Analysis:

Call side we can clearly see Short build up on every Strike price above ATM. Which indicating that call writers are very aggressively sold Call option. 12000 strike was actively traded today and writers added short position keeping in mind that market will remain below 12k. As per call data market is going to bearish.

Put Side Analysis

Put side also we are seeing Short build on all the below strike out information on sal n mostly action happened on 116000. Put side dat suggest heavy put wrthin th range?

Put side is more strong than previous day and it has managed to close above 1950 which it good reversal . OI got added at 11800 which will be act strong level for tomorrow.

Interesting fight between Bull ad bears tomorrow.

On the day of expiry try to trade only ATM strike price.

Tomorrow day may be highly volatile .as per option data.

FII's Position wise analysis

FII's were net buyer every where Index F&O along with Stock Future & Option. which indicating positive opening for early sessions but as mentioned above profit booking can happen on all the increments.

FII's & DII's Analysis:

FII's are very opportunist they are real market movers and holding the market in bull's hand whenever fear in the market they are the one keeping this market again wherever they wants it should be.

As per their aggression of buying in the market from last three session one can assume they are not happy with current level of nifty they want nifty to reach at certain level. What that could be? All data suggests that level could 12250 or above so that they can dumb. That why they are buying on all the dips.

Market nowadays reacting to all news so one should not miss any important news out there.

Conclusion

Bottom line of all the analysis is market sentiment is still positive, its just some rumors and news related to us market or corona news fears are creating pain among traders.

Treat all dips as opportunity but same time keep booking profit on all increments.

There will be hickups like everyday to counter that use price action strategy shared in recent video and act accordingly.

Subscribe to StockGeni Prime group to get daily live market analysis like market reversal or live nifty level or Price action analysis what and when is gong to happen before its happen.

Comments